February 13, 2019

The Industries Most Likely to Ask for a Business Loan and Why

No matter the source, a business needs funds to not only keep its doors open but more importantly, to grow. What it uses its funds for, however, is another story.

In this post, we’ll review the industries that are most likely to request a business loan and the main reasons why they apply for financing in the first place. Is your industry on the list?

Which Industries Are Most Likely to Apply for Financing?

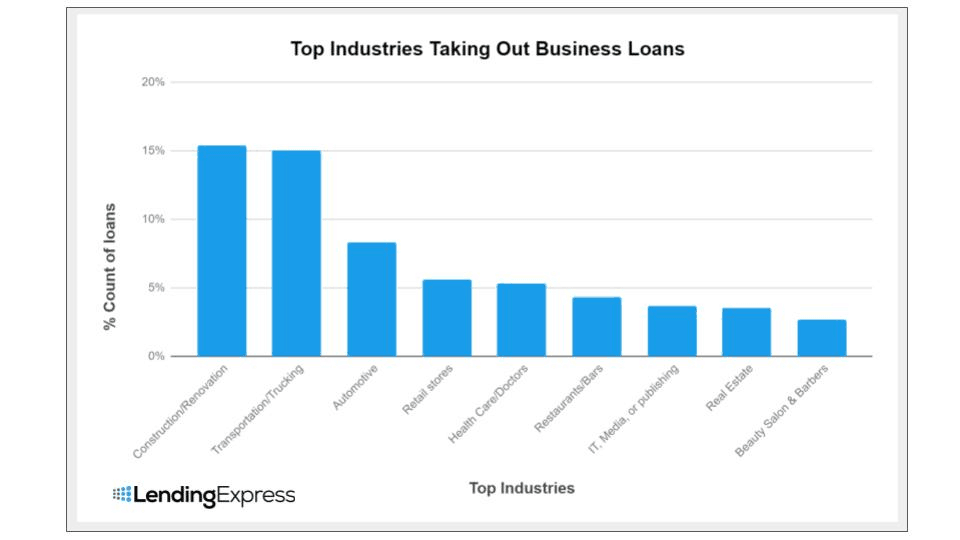

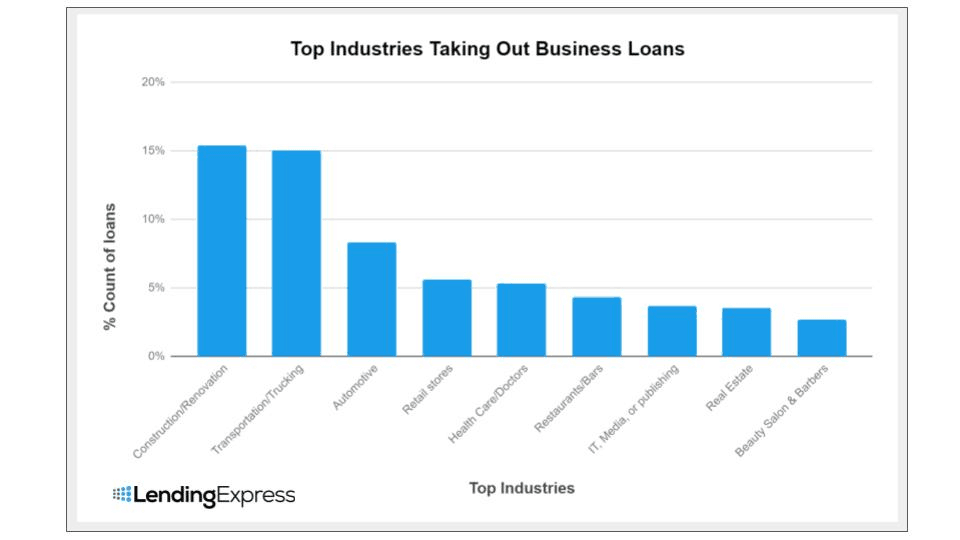

Lending Express analyzed its data from 2018 to find out which industries are most likely to take out a loan. The stats accounted for over 60 different industries. In the graph below, we’ve selected the top nine:

First Place: Construction and Renovation

According to our data, the construction industry came out on top, with a little over 15 percent of loans facilitated through Lending Express handed out to this sector. Businesses in the construction and renovation industry generally need funds to cover the cost of their equipment - and this particular industry goes through equipment like a bear stocking up for hibernation. Equipment loans help construction businesses to purchase large pieces of machinery such as excavators, bulldozers, and cranes – which certainly aren’t cheap! With the need for new offices and housing continually increasing, it’s no wonder that this industry came out on top.Close Second: Transportation and Trucking

The transportation sector is responsible for companies providing services to move both people and goods (trucking). The trucking industry especially is in huge demand, what with consumerism up 3.8 percent in 2018 with yearly spending of $14.1 trillion, those goods have to get from A to B somehow. 51 percent of global retailers now offer same-day delivery, because after all, who doesn’t want their goods to arrive the day of order? With such demanding schedules, the trucking industry is in constant demand for new drivers and trucks, which is why these business owners are pursuing business funding, particularly vehicle loans to cover the costs.Top Reasons Businesses Take Out Loans

We’ve covered the industries that are most likely to pursue a loan, but perhaps more important is the reasons as to why they need that business loan in the first place. Many people associate the need for a business loan with a failing business but on the contrary, access to capital is needed for a variety of reasons, most notably, to propel a business to the next level. We dove into the data we have here at Lending Express for the years of 2017-2018 to break it down for you. Now you can see where other businesses are spending their funds. Here they are, in order...1. Working Capital

39 percent of applicants take out a loan to cover ‘working capital.’ This means that most businesses are using their funds for materialistic use to cover the finances involved in everyday operations. This is especially beneficial to companies that don’t have stable revenue throughout the year. For example, retail businesses typically sell more during the busy holiday season.Using funds to cover working capital is best for short-term financing such as:

- Payroll

- Rent

- Bills

2. Expansion

It’s common for entrepreneurs and business owners to be itching for growth, and how do they do it? With the right building blocks, which includes financing. According to our data, 20 percent of business owners claimed that their funds were going towards business ‘expansion.’ Everyone knows the age-old adage; it takes money to make money, and financing used in the right way will give that extra push.Funds for expansion can be used to:

- Hire new employees

- Become a franchise

- Open a new branch

- Introduce a new product/service

- Buy new equipment and more...