March 14, 2020

The Importance of Calculating Your Inventory Turnover Ratio

There are many ways to improve your sales numbers, and thus your bottom line. One of the most effective methods to do this is to calculate inventory turnover.

What is Inventory Turnover?

Inventory turnover is a ratio that measures the number of times inventory is used or sold in a given period. The most commonly selected time chosen for inventory turnover ratios is a year. Knowing this inventory turnover ratio is crucial to many different industries. It assists in projecting the time it'll take to sell inventory. Also, it helps to determine when you are going to need additional inventory. This ratio can be calculated by dividing the days in your selected timeframe by the standard inventory turnover formula, covered below. The resulting number is an estimate of how many days it should take to sell your inventory.The Importance of Inventory Turnover

If you're a retail owner, you know how crucial accurate inventory management is. Each stocked product, and every square foot of space (including storage costs), affect your business’ bottom line. When each month, quarter, and fiscal year ends, the profits or losses on your balance sheet reflect three things:- The products you offered to your customers.

- Values of these items compared to their costs.

- How quickly your business was able to push these products through your storefront and into your customers’ hands.

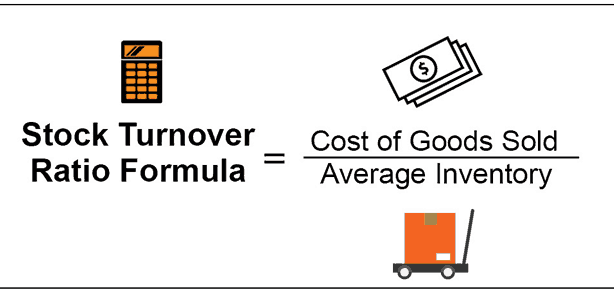

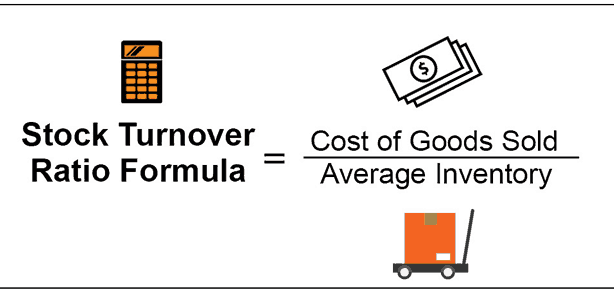

The Inventory Turnover Ratio Formula

The golden inventory turnover ratio is a measure of the number of times inventory is sold over a given period. There's a relatively simple calculation to determine how to find this number: Inventory turnover = Cost of goods sold / Average inventory To calculate an inventory turnover ratio accurately it’s crucial to calculate both average inventory and COGS. But what are these?

About Cost of Goods Sold

The cost of goods sold is a great place to start. These represent direct costs that are associated with the purchase or production of products that are sold to consumers. For manufacturers, cost of goods sold includes costs of labor and materials required. For retailers who don't make their products, it'll just be the product purchase price when it's obtained from manufacturers. There are a few examples of cost of goods calculation that can assist in preliminary inventory turnover ratios. After all, it’s essential to ensure that no stone is left unturned, as this can affect turnover and profits.- Retail Electronics

- Watch Designers

About Average Inventory

There’s some excellent news about the calculation of average inventory. When you’ve determined the COGS of your business, most of the work for average inventory is done already! Why is this? The only difference between these numbers is that the COGS will reflect the production or acquisition costs of purchased items. However, the cost of inventory is the same value for things that are currently on hand, or not yet sold. Calculating average inventory value uses similar calculations as found above. Meaning, the wholesale purchase price or the material and labor cost when making products on your own. Then, these are applied to inventory being held in-house at a specified point in time. However, it’s crucial to keep in mind that the amount of inventory on hand fluctuates in close to real-time. One strong example of this is the shipment receiving time. The day before and the day after receiving a massive inventory shipment shifts this value considerably. This is why the average inventory calculation exists. It provides a more definite idea of what consistent inventory levels are. The formula used to calculate average inventory over a given time is: Average inventory = (Value of inventory at the beginning of period + Value of inventory at the end of period ) / 2Why Time Period Matters For ITR

Inventory measurements can be applied at different periods when calculating your turnover ratio. While one year is typically standard, there are times when you might want to calculate this value monthly or weekly. Retail stores that experience substantial seasonality are an excellent example of this. Inventory turnover during Christmas week will differ from the middle of April for greeting card stores. Turnover for swimming pool supply stores will be different in June than in December. Regardless of the range, you must apply the same date range to COGS that you do for average inventory calculations. If not, you’ll be comparing apples to oranges. You want your inventory turnover ratio to reflect what is going on inside your business accurately. Ensuring the same time period is being used for both calculations will help make sure your ITR is accurate.When Is An Inventory Turnover Ratio Considered “Good”?

In broad terms, the standard rule of thumb for inventory turnover ratios is higher is better. However, there are limitations to this. If you have a severely low inventory turnover, this usually means your inventory spends excess time on shelves. This inventory isn't adding any value to your business’ bottom line. In the end, it translates into money spent on space where this inventory is just going to sit around. In addition, you have a higher risk of inventory damage and overall depreciation.Having Too Much

For goods that are considered non-perishable (apparel, electronics, and more), you can have an inventory turnover ratio that's too high. For one thing, higher inventory turnover ratios can mean nothing more than higher volumes of sales. However, it may also reveal that you aren’t keeping inventory in stock to meet customer demand adequately. This draws back to the electronics store example above. If Apple products sell out the same day they enter the store, this is a sign to order larger product shipments. While this is technically a fantastic problem to have, you would be remiss not to keep an eye on things. It's detrimental for your customers to resort to your competition for their Apple fix if your inventory is inadequate.Considering Product Types

In these cases, what can be regarded as a “normal” range for inventory turnover ratios? Sadly, this number changes drastically based on a variety of factors. Some common factors include products being sold, the nature of the business, consumer demographics, and seasonality. One strong example of this is stores selling perishable goods and food (bakeries, grocery stores, coffee shops, etc.). These establishments tend to have very high inventory turnover and for a good reason. Their products lose value and expire far faster than our electronics store example. Dairy products that aren't pasteurized will have a shelf life of just a few days. The same goes for produce. Meanwhile, that new iPhone can sit on shelves for a year and retain its value.

An Example Of Inventory Turnover

To truly understand calculating inventory turnover, an example is best. Let’s say an electronic store, reports in their income statement that their cost of goods sold is $4 million. They started the fiscal year with $500,000 in inventory and ended with $1.5 million in stock. To get their inventory turnover ratio, the first thing to do is to determine the average inventory. First, you'll add the beginning inventory value ($500,000) to the end inventory value ($1.5 million). Then, divide this sum ($2 million) in half to determine the business's median inventory at any given time. The result of this is $1 million in average inventories. Finally, divide the electronic store's cost of goods sold, which is $4 million, by your average inventory number. This results in an inventory turnover ratio value of four. So, this means they sold its full inventory stock four times through a fiscal year. Alternatively, it took them an average of close to 92 days to sell out inventory. Still, the question remains: What is a good inventory turnover ratio? Vend notes that for retail service providers, ideal ITR is typically between two and four. For this reason, the electronic company is at the high end of strong ITR.Applying Inventory Turnover

Why is the application of inventory turnover ratio so crucial in your business? After all, it’s a relatively simple calculation, so it can’t be that crucial, right? Wrong. Below are some ways that inventory turnover can be applied to your business for essential decision making.- Turnover by Category or Product

- Total Inventory Turnover

- Product Seasonality of Inventory Turnover

- Seasonality of Overall Inventory

- ITR for Marketing Analysis/Product Placements

Improving Inventory Turnover

Now, you know what your inventory turnover ratio is. You know how to calculate your business’ ITR, and what results to be on the lookout for. Also, you can apply the ITR to different facets of your business. Naturally, your next question should be, how do you go about improving your inventory turnover ratio? If you calculated your ratio and aren’t happy with your numbers, there are ways to move inventory more effectively:- Practice conservative ordering practices

- Don’t be afraid to move products around

- Complementary products work wonders

- Put a focus on your marketing efforts

- Discounts can provide that extra boost