Small Business Finance: 5 Simple Steps to Build a Cash Flow Forecast

Running a small or medium-sized business is like flying a plane. One day, everything's smooth; the next, you hit turbulence — there's an unexpected expense or headwinds slow down sales. A cash flow forecast helps you prepare for challenges and make smarter decisions. If you've never built a forecast before, don't worry. This blog post will walk you through the five easy steps to create a cash flow forecast.

Why You Need a Cash Flow Forecast

Before we get to the how-to, let's first address why forecasting matters. Cash flow is the lifeblood of your business, it keeps operations running, pays your team, and funds your growth. But without a clear picture of what's coming in and going out, you're flying blind. With a forecast, your monthly cash flow stops being a mystery and starts becoming a strategic lever.

According to a recent survey, small and medium-sized business owners are getting more proactive about anticipating future needs:

54% are revising expenses to stay lean and efficient

54% are adjusting pricing to match market conditions

37% are thinking ahead about access to capital to stay flexible

In fact, there are at least 6 key business decisions where a forecast can prove indispensable for small and medium-sized businesses. So now that you see how essential a cash flow forecast is to your business, here's how to build one.

5 Simple Steps for Building a Cash Flow Forecast

Step 1: Gather Your Data

You'll want to start with two areas:

What's happening with recent sales and expenses within your business. Take a particularly close look at your biggest expenses and most valued customers. Are there potential price increases or capital expenditures on the horizon? Do you think the volume of purchases will increase or decrease?

What's happening around your business, because outside factors can have a major influence. Are competitors exiting your market or new ones entering? Are there any upcoming changes to your industry, location, or the economy that could impact you?

Step 2: Set Up Your Spreadsheet

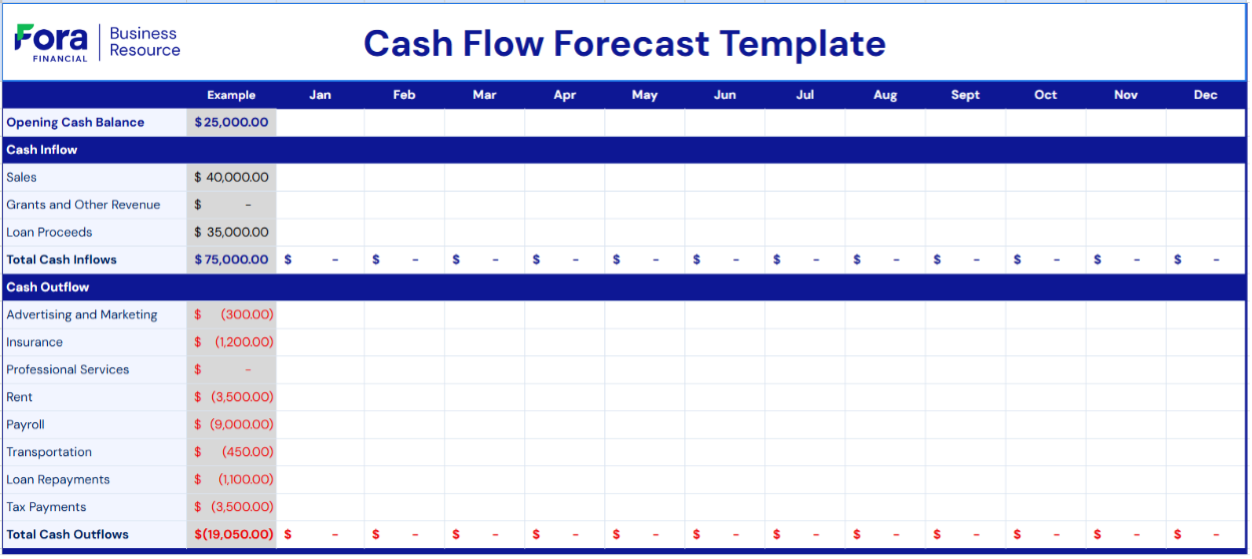

A simple spreadsheet is all you need to create your forecast. Download our pre-built spreadsheet to Excel or save a copy to your Google Drive. Your spreadsheet should have a column for each of the upcoming 12 months and rows for 4 main sections:

Opening balance: The cash you start each month with

Cash inflows: All the money coming in (sales, payments, grants, etc.)

Cash outflows: All the money going out (rent, payroll, supplies, etc.)

Closing balance: Cash remaining at the end of the month, which becomes the opening balance for the next month

For each month, estimate your inflows and outflows based on past patterns and current trends. For example, if you run a retail shop, consider seasonal spikes around holidays or slower periods in January.

Your spreadsheet might look something like this: (Note that your spreadsheet should have columns for 12 months.)

Step 3: Understand Your Cash Flow

Now, take a close look at each month's closing balance and ask yourself:

Are there months where the balance dips too low or goes negative?

Do I have enough cash to cover big expenses, like new equipment or payroll?

If there are gaps, what short-term financing options can I tap into?

Step 4: Plan for Best and Worst-Case Scenarios

Your first forecast is a starting point, but the future isn't set in stone. Create two additional versions of your spreadsheet to test different scenarios:

Best-case scenario: What if sales exceed projections or a new client signs on? Increase your inflows by the expected amount. Similarly, if you're considering a new supplier that can reduce your costs, adjust your cash outflows downward.

Worst-case scenario: What if a major client delays payment or a nearby construction project slows down foot traffic? What if costs rise? Adjust your cash inflows and outflows accordingly to prepare for challenges.

These scenarios help you see how much wiggle room you have and where you might need extra funding or cost-cutting.

Step 5: Update Your Forecast Regularly

A forecast isn't a one-and-done task. It's a rolling 12-month view, so set a reminder to revisit it every 2 to 3 months to keep your outlook current. Regular updates let you:

Catch cash shortfalls early

Be proactive in adjusting your strategy

Make decisions using real data

Get Ahead of Cash Flow Gaps With Fast, Flexible Funding

Cash flow forecasting takes very little time, yet its impact is incredibly powerful. With a forecast, you can anticipate when you may need short-term funding to cover gaps in cash flow. And with ready access to working capital, you can cover costs while you wait for revenue, take on new opportunities without delay, and have a cash cushion to cover the unexpected.

Fora Financial understands the needs of small and medium-sized businesses. We work fast, providing approvals within hours and funding within days. Our terms are flexible (with terms up to 24 months), our process is light on paperwork, and our support comes from real people you can talk to. What you won't find? Surprise fees or limits on how you use your funds.

Want to learn more about cash flow forecasting? Download our free ebook: Plan Better For What's Ahead: Forecasting Made Simple For Small Businesses.

And to jumpstart your cash flow forecast, download our pre-built spreadsheet to Excel or save a copy to your Google Drive.

Since 2008, Fora Financial has distributed $4 billion to 55,000 businesses. Click here or call (877) 419-3568 for more information on how Fora Financial's working capital solutions can help your business thrive.