March 24, 2017

How to Prepare an Income Statement

One thing all business income statements have in common is the distinction between revenue, which is the net income from sales, and net profit (also called net income), which is how much the company made (or lost) after paying all its expenses and costs.

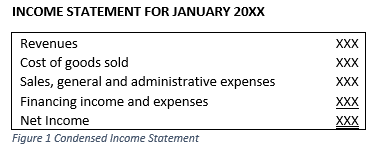

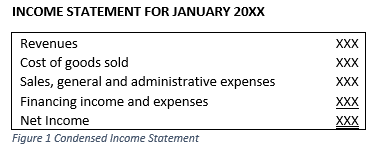

In this format, a few expense categories are subtracted from revenues to product net income. This version would be appropriate for a small merchandising business. You calculate cost of goods sold (COGS) as equal the value of beginning inventory plus inventory purchases, minus ending inventory. COGS does not include distribution costs. Sales, general and administrative expenses include indirect costs required to sell your product (such as travel, distribution), general costs (such as office supplies) and administrative costs (legal, accounting). Financing income and expenses includes interest and taxes. The remainder is net income, or net profit.

The single-step income statement provides more detail:

In this format, a few expense categories are subtracted from revenues to product net income. This version would be appropriate for a small merchandising business. You calculate cost of goods sold (COGS) as equal the value of beginning inventory plus inventory purchases, minus ending inventory. COGS does not include distribution costs. Sales, general and administrative expenses include indirect costs required to sell your product (such as travel, distribution), general costs (such as office supplies) and administrative costs (legal, accounting). Financing income and expenses includes interest and taxes. The remainder is net income, or net profit.

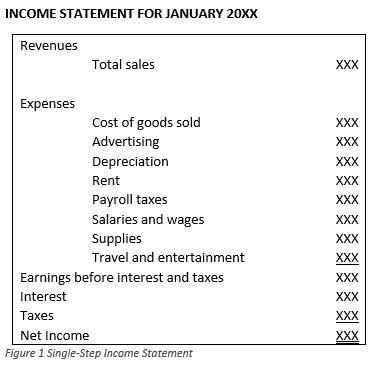

The single-step income statement provides more detail:

As you can see, more detail is given in the single-step format so that the reader has a better understanding of income and expenses.

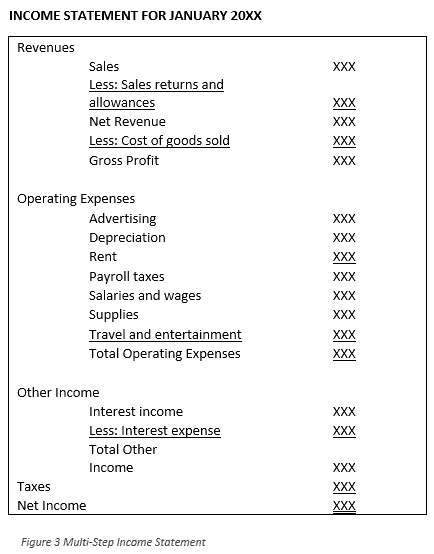

The most detail is provided by a multi-step income statement:

As you can see, more detail is given in the single-step format so that the reader has a better understanding of income and expenses.

The most detail is provided by a multi-step income statement:

In most cases, the bottom line is net income, the total of all income and expenses. Some companies also report other comprehensive income, which is income earned as a result of events outside the business’ control, such as pension costs or currency translations.

In most cases, the bottom line is net income, the total of all income and expenses. Some companies also report other comprehensive income, which is income earned as a result of events outside the business’ control, such as pension costs or currency translations.

Revenue vs Profit

The profit and loss statement starts off with gross revenue, also called gross sales. After you subtract sales allowances and returns you have net sales. Once you deduct the cost of goods or services sold, you have your gross profit for the period. You can figure your net profit by further subtracting all your other expenses, including overhead, taxes and interest. The bottom line net profit, if positive, means you earned more than you spent. The process of going from gross revenue to net profit may seem easy, and for small companies it often is. Larger companies may have fiendishly complicated procedures for generating an income statement. The answer for how to prepare an income statement is to follow the rules of accounting as dictated by generally accepted accounting principles, or GAAP.The Income Statement

Contents

The income statement is one of the “Big Three” financial reports, along with the balance sheet and the cash flow statement. Although formats differ, the income statement contains these items:- Revenues and Gains

- Revenues from operating activities

- Revenues or income from secondary activities

- Gains from non-operational sources (lawsuits, sale of property)

- Expenses and Losses

- Expenses from operating activities

- Expenses from secondary activities

- Losses from non-operational sources

Formats

There are several ways to present the income statement. The simplest is the condensed version: In this format, a few expense categories are subtracted from revenues to product net income. This version would be appropriate for a small merchandising business. You calculate cost of goods sold (COGS) as equal the value of beginning inventory plus inventory purchases, minus ending inventory. COGS does not include distribution costs. Sales, general and administrative expenses include indirect costs required to sell your product (such as travel, distribution), general costs (such as office supplies) and administrative costs (legal, accounting). Financing income and expenses includes interest and taxes. The remainder is net income, or net profit.

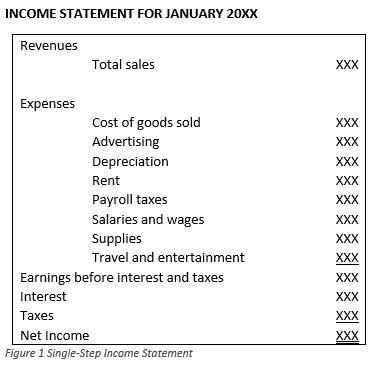

The single-step income statement provides more detail:

In this format, a few expense categories are subtracted from revenues to product net income. This version would be appropriate for a small merchandising business. You calculate cost of goods sold (COGS) as equal the value of beginning inventory plus inventory purchases, minus ending inventory. COGS does not include distribution costs. Sales, general and administrative expenses include indirect costs required to sell your product (such as travel, distribution), general costs (such as office supplies) and administrative costs (legal, accounting). Financing income and expenses includes interest and taxes. The remainder is net income, or net profit.

The single-step income statement provides more detail:

As you can see, more detail is given in the single-step format so that the reader has a better understanding of income and expenses.

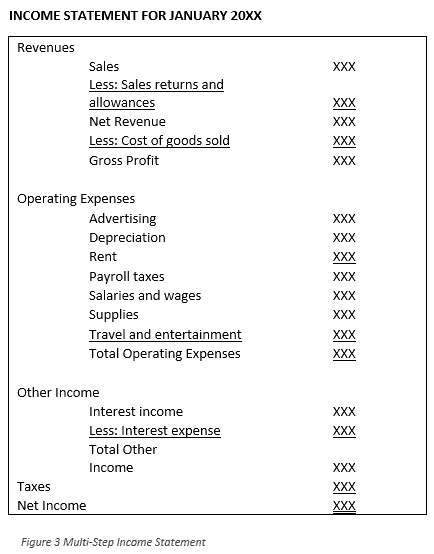

The most detail is provided by a multi-step income statement:

As you can see, more detail is given in the single-step format so that the reader has a better understanding of income and expenses.

The most detail is provided by a multi-step income statement:

In most cases, the bottom line is net income, the total of all income and expenses. Some companies also report other comprehensive income, which is income earned as a result of events outside the business’ control, such as pension costs or currency translations.

In most cases, the bottom line is net income, the total of all income and expenses. Some companies also report other comprehensive income, which is income earned as a result of events outside the business’ control, such as pension costs or currency translations.

Quick Income Statement Tips

- You can generate a professional-looking income statement if you use business or accounting software. These packages have the added benefit of stepping you through all the procedures necessary to prepare your financial statements.

- If you’re only using the income statement internally, the formatting isn’t as important. If you must publish your income statement, great care should be given to its appearance (and its accuracy).

- If you are a service organization, you would replace COGS with cost of services sold.

- If in doubt, hire a professional to do your bookkeeping and generate your financial statements.