January 30, 2020

Fundraising Through Reverse Merger: What You Should Know

Reverse mergers are a process companies can use to change their business capital structure without the extensive requirements from the Initial Public Offering (IPO). Once they are public, they have more options for raising the working capital needed to maintain or expand their operations.

Working Capital Is The Lifeblood Of Business

Working capital is the funds used to carry out the normal operations of businesses. Part of these funds can be used for new investments in the business. This foundation allows businesses to expand. Working capital requirements aren't limited to the core operations of your business. Office equipment breaks down, utility bills increase, and a host of unexpected costs can strain your working capital. It’s little wonder that the failure rate is high for small businesses. When companies manage their working capital properly, they increase their odds of success. Business owners often aren't aware of the different funding methods that are available to them. This lack of knowledge can cost them their businesses. The main types of funding are equity and debt. With equity funding, the owner transfers a portion of ownership to investors. With debt funding, the owner maintains the equity, but the credit rating of the company changes. Small business owners are usually limited to private equity in the form of angel investing or venture capital deals. IPOs are generally considered to be off-limits due to the strict requirements and costs associated with this option. A less-known option for businesses is a reverse merger. This process helps private companies become public ones. Public companies have more options available to find working capital sources.So, What Is A Reverse Merger?

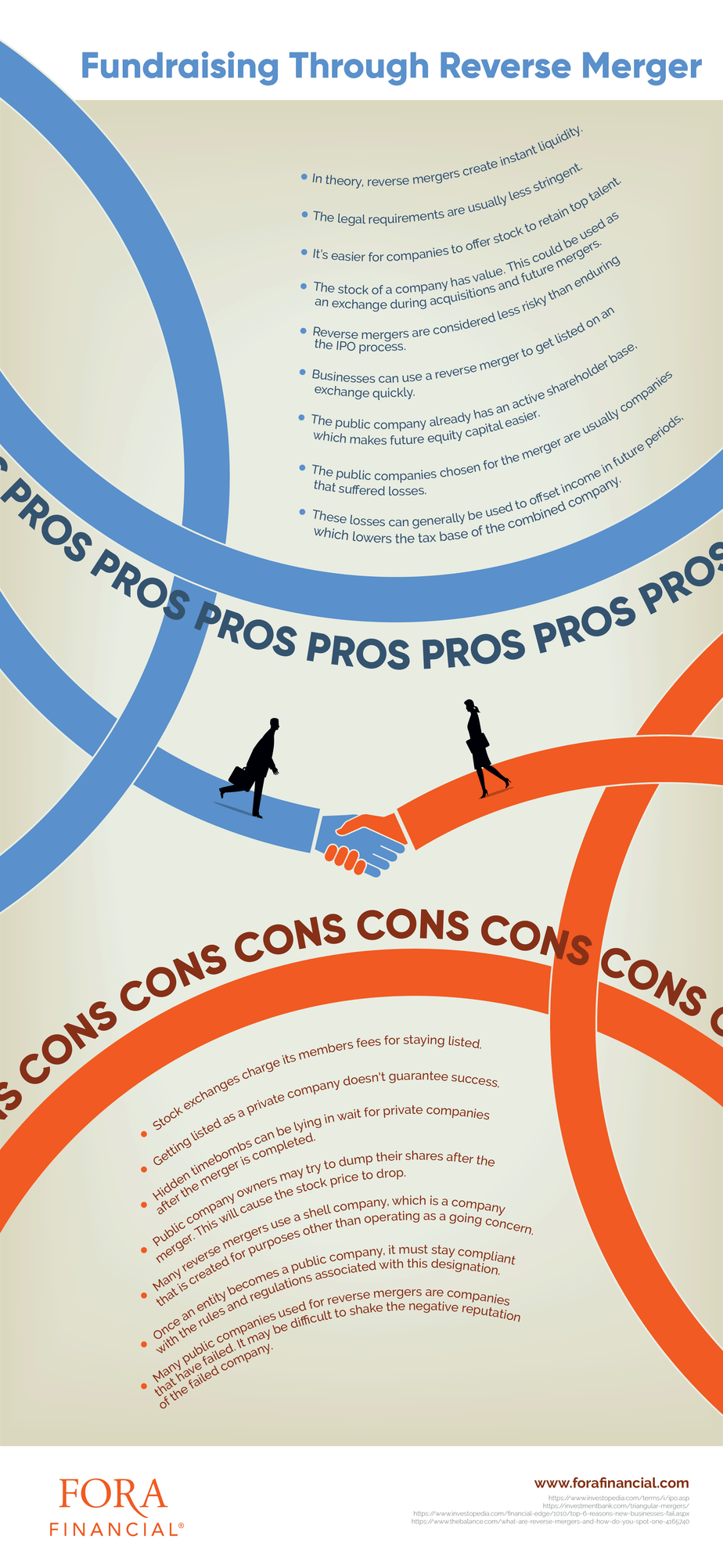

It pays to be able to answer the question "what is a reverse merger?" Companies can raise capital in one of two ways: equity and debt. The difference between these two structures is how ownership is transferred. Business owners give up a percentage of ownership during equity funding. The most liquid form of raising equity is via the stock market. However, this requires registering for a public listing of the company, usually via an Initial Public Offering (IPO). An IPO is an extensive process. Some companies who wish to bypass this process opt for a reverse merger. The basic aspect of a reverse merger is two companies merge where one of the companies are already listed. Since one of the companies are listed on the exchange, the IPO process is bypassed with the merger. There's nothing inherently illegal about a reverse merger. Well-known companies, such as The New York Stock Exchange and Berkshire Hathaway, used reverse mortgages to avoid the IPO process. However, reverse mergers can be used to commit fraud. A similar term, called a reverse triangular merger, is similar to a reverse merger. The main difference is that a subsidiary is created and is used as part of the merger. A reverse merger is a vehicle to change the structure of a business from private to public. This vehicle has advantages and disadvantages, as described in the following sections.The Pros of Reverse Mergers

- Businesses can use a reverse merger to get listed on an exchange quickly. They don’t need to seek out investment banks or go through lengthy due process periods.

- The legal requirements are usually less stringent.

- The public company already has an active shareholder base, which makes future equity capital easier.

- Reverse mergers are considered less risky than enduring the IPO process. Not every IPO is successful and can result in being delisted.

- In theory, reverse mergers create instant liquidity. Shares of public companies are traded on exchanges, which makes access available to a broader group of investors.

- It’s easier for companies to offer stock to retain top talent. They can offer stock options and warrants, too.

- The stock of a company has value. This could be used as an exchange during acquisitions and future mergers.

- The public companies chosen for the merger are usually companies that suffered losses. These losses can generally be used to offset income in future periods, which lowers the tax base of the combined company.

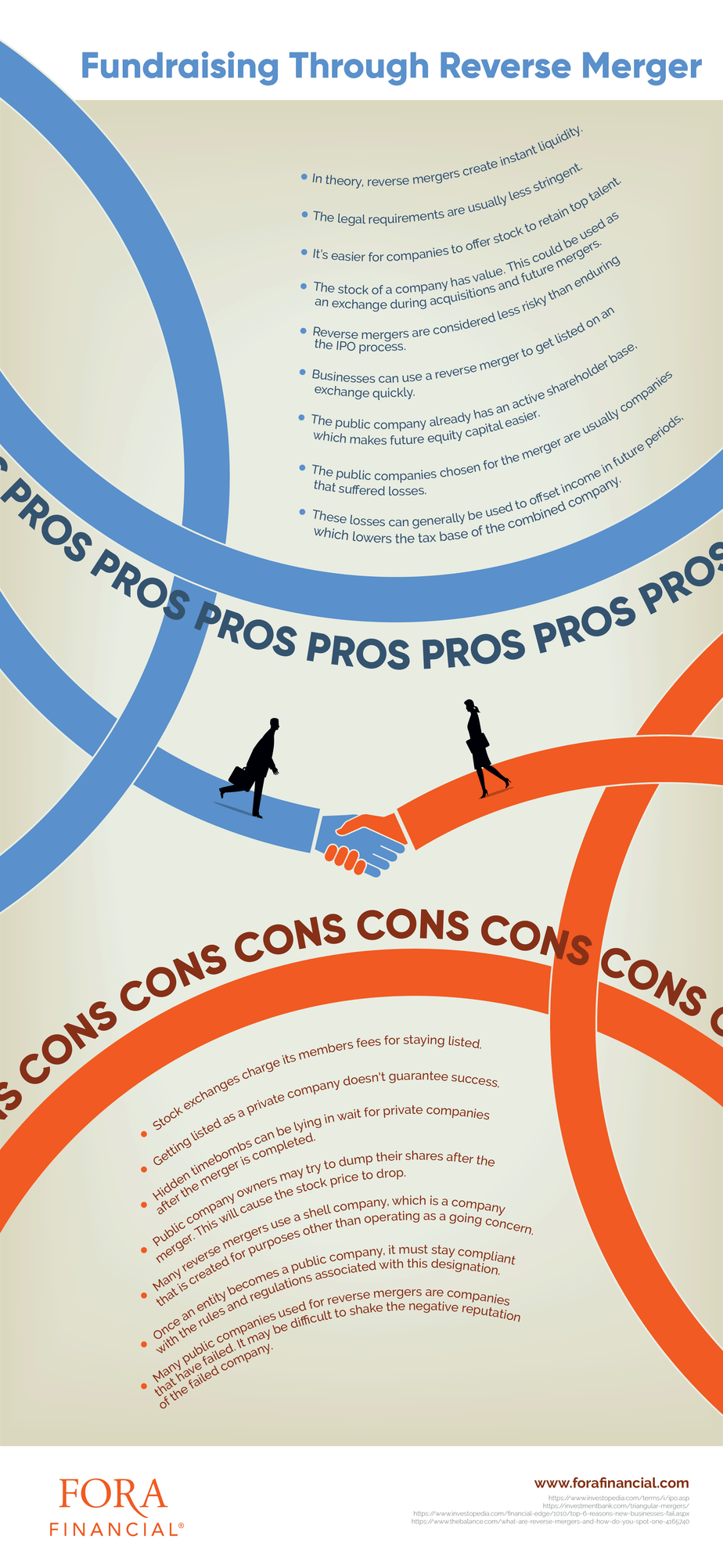

The Cons of Reverse Mergers

- Getting listed as a private company doesn't guarantee success. For instance, if a stock’s price falls below a certain threshold on the New York Stock Exchange, it risks being delisted. Each exchange has different requirements for staying compliant.

- Stock exchanges charge its members fees for staying listed. These fees are usually significant.

- Many reverse mergers use a shell company, which is a company that is created for purposes other than operating as a going concern. While it’s not illegal, it can raise suspicion.

- Hidden timebombs can be lying in wait for private companies after the merger is completed. If these aren't uncovered before the merger, they could cause problems for the private company.

- Once an entity becomes a public company, it must stay compliant with the rules and regulations associated with this designation. The reporting requirements are extensive for public companies.

- Many public companies used for reverse mergers are companies that have failed. It may be difficult to shake the negative reputation of the failed company.

- Public company owners may try to dump their shares after the merger. This will cause the stock price to drop. The private company should add a holding period clause to the merger agreement to prevent this.

How To Get A Reverse Merger

A reverse merger isn't a capital raising activity. Therefore, if your goal is to raise capital immediately, this process may not be right for your company. Typically, you’ll want to seek out companies that are still listed on an exchange but have fallen out of favor with investors. Their stock prices have declined, and they struggle to keep afloat. One method of finding a shell company is to search for companies that have declared bankruptcy. The filing is public record, and many cases will be newsworthy. For instance, you can scan for stories on recent bankruptcies. You can look for companies that haven't yet declared bankruptcy but are experiencing financial difficulties. This information can also be found in the news. You can reach out to these companies and offer a reverse merger agreement. Some companies specialize in matching public and private companies for reverse mergers. They handle most of the legwork for you. They also have an inventory of public companies ready to go for your reverse merger needs. They usually charge fees and require equity in exchange for their service. The legal requirements may be less for reverse mergers than with IPOs, but there are some legal aspects to them. Hiring a qualified lawyer can help you satisfy these requirements.