Risk Mitigation in Your Small Business

Owning a small business means taking chances. No matter how much preparation, education and experience you have in your field, internal and external factors can damage your hard earned reputation or hurt your finances.

When you own a small business, you can anticipate potential risks before they become a problem by having risk mitigation strategies in place to minimize their impact. Be prepared to protect your small business from risks by coming up with a risk mitigation plan. Taking control of the situation before it gets bad will allow you to be one step ahead of the drama.

Ready to start formulating your risk mitigation plan? This is one of the many questions people have when starting a business. Keep reading to begin mitigating risk in your small business!

First Off, What is a Risk?

Depending on the type of business you own, there are a wide variety of risks you could encounter. Basically, a risk is anything that could damage your company’s reputation or finances, costing you opportunities along the way. You should devote a section of your business plan to discussing possible risks, so that you're prepared for potential issues.

If you own a small business, a risk can come from the external factors that contribute to your company’s success to the stability of your internal staff.

Is a larger corporation targeting your consumer base? Or, did you hire an employee without getting a reference? Both examples can be considered risks. To identify risks, think about different scenarios that could result from your actions, as well as those out of your control.

Preparing Risk Management Plans

When it comes to implementing risk management for your business, it’s a good idea to come up with a plan. To do this, you'll need to identify potential internal and external risks for your company.

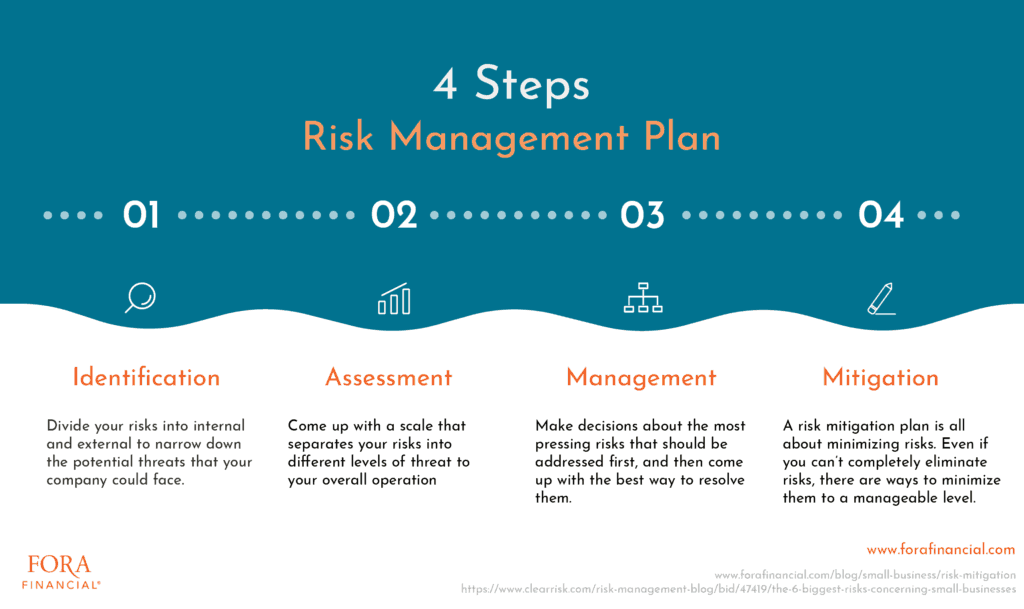

The more specific your risk management strategy, the better suited it will be to meet your specific needs. An organized method to the madness of controlling risk is to identify risks, assess, manage, and mitigate. By following these four steps you can come up with an airtight risk management plan for your business.

Risk Identification

Identifying risk is the first step in preparing your risk management plan. Divide your risks into internal and external to narrow down the potential threats that your company could face.

Internal Risks:

These are risks that you can directly control. Examples of internal risks are being understaffed before a big event, needing to update data storage, or overspending.

External Risks:

You should have your eye on potential risks from competitors and other market influences.

Consider your competition, where you stand in the market, and how external factors could harm the wellbeing of your company. To do this, ask yourself questions such as:

Is the market in which you operate currently oversaturated?

How will you stay afloat with the changing nature of the larger economy?

Could technology eventually effect or replace the product or service that you offer?

These are examples of external risk factors that you’ll need to identify before formulating a solid risk management plan.

Risk Assessment

Once you’ve identified your risks, it’s time to assess. Come up with a scale that separates your risks into different levels of threat to your overall operation. This could simply be two categories of risk, one being "high level threat" and another "low level threat".

Although your company might require a more nuanced scale for risk assessment, engaging in a simple separation of high level and low level threats allows you to prioritize what should be addressed first.

If you’re having trouble with risk prioritization (separating low level threats from high level threats), ask yourself questions about the risk. Here are some examples of questions you can ask about different risks to determine which you should address first.

Could this risk affect my business within the term or year?

Is this risk a threat to my current consumer base?

What are the long term effects of this risk?

Could this risk potentially cost me money, and if so how much?

Are other businesses experiencing this risk or is this risk specific to my company?

Is there a way I could address this risk that would resolve it quickly?

Risk Management

You’ve successfully identified and assessed your internal and external risks. Now it’s time to use your skill set to manage the risks!

Make decisions about the most pressing risks that should be addressed first, and then come up with the best way to resolve them. Coming up with a timeline can be a great tool to successfully managing your risks. With deadlines set in place, you can hold yourself and your team accountable for meeting risk management goals.

In addition, try to set measurable goals. For example, let's say you own a bowling alley and another bowling alley just opened nearby. Instead of setting a vague goal like "compete with the new bowling alley by marketing to local millennials," create a goal that's more concise.

In this situation, you'd ask yourself questions like "how am I going to measure the success of our marketing campaigns?" Or, "how do we define millennials?"

A more measurable risk management goal would be, "launch a month-long campaign to target consumers aged 22 to 35 within 5 miles of the bowling alley with flyers and text marketing messages to see a desired increase of 10% of new monthly visitors for the month of November." Be as specific as possible about your desired result and how you plan to accomplish that result.

Risk Mitigation

There are some risks that you won’t be able to completely eliminate. After all, there is only so much you have control over in your small business. A risk mitigation plan is all about minimizing risks. Even if you can’t completely eliminate risks, you can still strive to reduce risks to an acceptable level.

For example, let’s say your biggest risk as a company is the amount you have to spend on labor in comparison to revenue from selling your product. Consider cutting down on unnecessary labor and raising the price of your product by small margins to help mitigate the risk. If you can decrease the severity of a risk, you can consider it a win for your small business.

How to Get More Information

If you’re looking for more ways to mitigate risks at your small business, you have options. From local small business workshops to reading literature on risk management, discovering different opinions on risk mitigation can help you find what works best for you.

In addition, asking other small business owners in your area about their risk management techniques can help you come up with a plan that works in your specific market. By communicating with similar businesses, you’ll also be able to form valuable connections that you can use in the future.