January 27, 2020

10 Tips For Commercial Real Estate Investing Businesses

About Commercial Real Estate Investing

Commercial real estate investing is becoming popular for several reasons. The market continues to thrive along with the robust economy. These conditions make starting a business in commercial real estate a wise choice. The landscape for commercial real estate is broad. It pays to narrow your focus to one area that makes the most sense for your portfolio. For example, if you already understand about office buildings, you may choose to concentrate on this aspect of the business. You don’t have to limit yourself to one area. However, you don’t want to overextend. Commercial real estate can be profitable, but it requires investors to learn their markets well. The more markets you try to learn, the more complicated your investing becomes. There are pros and cons to all investment asset classes, including commercial real estate. By understanding these, you’ll be better equipped to handle situations that arise from your business operations. The following discusses some of the pros and cons of investing in commercial real estate.The Pros of Commercial Real Estate Investing

- Commercial real estate provides a relatively fast method of generating cash flows.

- It provides diversification in investing portfolios.

- Most real estate investment opportunities are based on hard assets, as opposed to a piece of paper (or electronic entry) like stocks.

- Investors are deeply involved in many aspects of the business.

- Taxes and expenses are often factored into the rent payments.

- Cash flows tend to be stable over time, especially when several properties are part of a diversified portfolio.

- Real estate tends to be a levered investment, meaning a fraction of capital is needed to purchase. As is shown in the next section, however, this can be a disadvantage, too.

The Cons of Commercial Real Estate Investing

- Real estate isn't considered a liquid investment when compared to other investment strategies. It can be difficult to unload properties in weak markets.

- Commercial real estate can be complicated for beginning investors. A lack of experience will cause wrong choices to be made.

- Commercial real estate requires more investment capital than many other investment types. However, there are methods that can help reduce these outlays.

- Investors must be well-versed on local ordinances and continue to stay informed. Compliance issues can be costly.

- If you're over-leveraged, a downturn in economic conditions can be devastating.

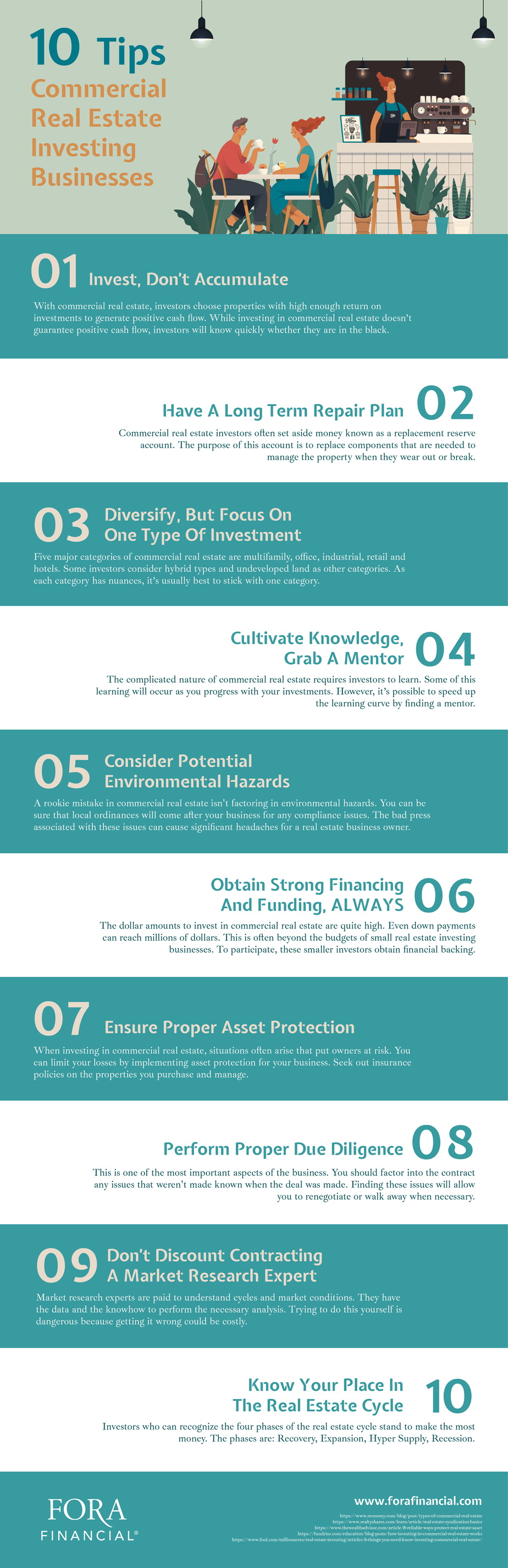

10 Tips For Commercial Real Estate Investing Businesses

Commercial real estate businesses are lucrative but complicated. New investors rush into starting real estate businesses, but forget to handle crucial aspects associated with the industry. When you learn about the factors affecting commercial real estate, you’ll make better choices with your investments. The following tips can help you start investing in real estate.1. Invest, Don’t Accumulate

When people invest in the stock market, they accumulate shares hoping the value increases later. Some companies pay dividends, but this payout is usually too small to matter. Conversely, with commercial real estate, investors choose properties with high enough return on investments to generate positive cash flow. This payout continues every period (usually monthly) until the property is sold. While investing in commercial real estate doesn’t guarantee positive cash flow, investors will know quickly whether they are in the black. For many stock investors, they won’t know for years whether their accumulated shares will bear fruit. Some stocks never do.2. Have A Long Term Repair Plan

Commercial real estate investors often set aside money known as a replacement reserve account. The purpose of this account is to replace components that are needed to manage the property when they wear out or break. An example of something needing replacement would be a new roof. This fund isn't used for daily operations. For instance, if a tenant calls the building manager for a clogged sink, this isn't the type of item that would draw from the replacement reserve account. How much you set aside for a replacement reserve depends on several factors. The age of the building is likely to be a factor. For older buildings, they may need more updates than newer construction.3. Diversify, But Focus On One Type Of Investment

Five major categories of commercial real estate are multifamily, office, industrial, retail and hotels. Some investors consider hybrid types and undeveloped land as other categories. As each category has nuances, it’s usually best to stick with one category. However, there is diversification available within those categories. For instance, in the multifamily category, investors can choose garden apartments, duplexes, and larger apartment complexes, like high rise apartments. There are subcategories in each of the main classifications. Some investors like to subdivide by the square footage of the property, as well. Many investors start with one type of investment but will level up to higher-dollar investments. As they learn about these markets, they gain the confidence to take it to the next step.4. Cultivate Knowledge, Grab A Mentor

The complicated nature of commercial real estate requires investors to learn. Some of this learning will occur as you progress with your investments. However, it’s possible to speed up the learning curve by finding a mentor. Someone who has experience in the commercial real estate space can help you boost your learning and your business's success. This person can steer you in the right direction and help you avoid costly mistakes. When searching for a mentor, don’t select one based on price alone. Good mentors are likely to cost money, but it'll be a worthwhile investment due to the knowledge they possess.5. Consider Potential Environmental Hazards

A rookie mistake in commercial real estate isn't factoring in environmental hazards. You can be sure that local ordinances will come after your business for any compliance issues. The bad press associated with these issues can cause significant headaches for a real estate business owner. You may need to perform deep research to find out issues associated with the properties. Try to learn about the history of the property. Was the current structure built on top of a chemical plant? Can you find historical news items on the businesses that existed on the property? Start with your municipality and ask a lot of questions about the property. It’s better to do this before you purchase as you can walk away when you find something out of place.6. Obtain Strong Financing And Funding, ALWAYS

The dollar amounts to invest in commercial real estate are quite high. Even down payments can reach millions of dollars. This is often beyond the budgets of small real estate investing businesses. To participate, these smaller investors obtain financial backing. Investors can reach out to private investors to obtain the capital required to fund deals. You’ll need to find investors willing to fund the same asset classes as the deals you want to go after. Other options include using real estate crowdfunding or syndication, which provides pools of funding for commercial real estate purposes. At Fora Financial, we provide capital to help business owners succeed. Contact one of our Capital Specialists for a free quote. [cta-freequote]7. Ensure Proper Asset Protection

When investing in commercial real estate, situations often arise that put owners at risk. You can limit your losses by implementing asset protection for your business. Seek out insurance policies on the properties you purchase and manage. Ensure proper coverage for as many possible situations that could arise. Consider protecting yourself by forming a corporation or LLC. Lawsuits are generally for big dollars, so keeping your personal assets protected is crucial. If you leverage your investments, this can help protect you against lawsuits to some degree. Lawyers go after assets, and if you don’t actually own those assets, they have nothing to claim.8. Perform Proper Due Diligence

In commercial real estate, performing proper due diligence can mean the difference in making money with deals. This is one of the most important aspects of the business. You should factor into the contract any issues that weren't made known when the deal was made. Finding these issues will allow you to renegotiate or walk away when necessary.9. Don’t Discount Contracting A Market Research Expert

The real estate market has cycles, just like any other market. When you learn these cycles, you’ll know when to spend and when to scale back. Market research experts are paid to understand cycles and market conditions. They have the data and the knowhow to perform the necessary analysis. Trying to do this yourself is dangerous because getting it wrong could be costly. Many real estate investors rely on intuition. While it’s okay to use intuition as part of investment decisions, it’s better to have an analysis to back them up. Otherwise, you could be shooting in the dark.10. Know Your Place In The Real Estate Cycle

Investors who can recognize the four phases of the real estate cycle stand to make the most money. The phases are described as follows: Recovery - Prices are low during this phase but could decrease further. While it could be a good time to buy, vacancy rates are higher during this phase, which means less rental income. Expansion - Savvy investors usually make their most money during this phase. The fence-sitters won't jump it, which leaves the market wide open to scoop up deals. Hyper Supply – Fence-sitters finally get off the fence and start buying. They don’t want to miss out. Smart money investors are starting to raise cash. Recession - As supply outpaces demand, prices drop. The smart money has sold, and many of the fence-sitters get burned. Vacancy rates are extremely high due to excess supply.